Welcome to another August Edition of KLM Spatial’s Industry Updates.

Economic roundtable summary

Discussions were aimed at lifting living standards, primarily by boosting stagnant productivity in Australia.

Sectors represented included banking, universities, mining, construction and superannuation, with attendees banned from bringing mobile phones.

Here are some of SBS’ key takeaways:

Labour market up-skilling – business Council of Australia chief executive Bran Black said unions had proposed charging employers a levy to provide skills, but businesses preferred an incentive for employers to bring on more apprentices.

Cutting of ‘red’ and ‘green’ tape – Housing Minister Clare O’Neil garnered broad support for a proposed pause to selected changes to the National Construction Code for the next 4 years. Pending updates include mandating EV charging infrastructure and improving fire proofing. The NCC2022 edition of the Code is now almost 3,000 pages. The Treasurer also made calls to expedite the current EPBC Act reforms review, find ways to fast-track clean energy projects and review how emission ‘polluting’ projects impacting climate, should be treated.

Supporting AI break throughs – Australia’s tech sector and unions will work together on a model that pays creatives for content used to train artificial intelligence. Regulation of AI was a major dividing line between employers and unions heading into the roundtable, with the ACTU calling for the government to force employers to consult with staff before introducing AI tools to the workplace.

Tax and intergenerational inequality – Segments argued for reforms to negative gearing and the capital gains tax discount which primarily benefit older established Australians, despite Labour shutting it down during the election campaign. Proposed changes to negative gearing and franking credits by the then Labour opposition, were not popular with voters in 2018.

On 24 August, changes announced to the First Home Guarantee Scheme, brought commencement forward to 1 October 2025, removed the cap on places and increased property price thresholds (e.g. Melbourne increased from $800,000 to $950,000)

Anthony is trying to build a house. It comes with 86 conditions, AFR

Sydney builder Anthony Malone received planning approval for a single storey house after 11 months, with the permit containing 86 conditions.

Practicing for over 30 years, he recently discovered a planning permit issued in 1991 for four townhouses that had 5 conditions.

To build homes, Malone said he had to pay professionals such as surveyors and structural engineers for: geotechnical reports, survey reports for building setouts and heights, landscaping design, stormwater design, driveway applications, structural engineering, sometimes bushfire and flooding reports.

He said how we can make housing affordable, when all these inputs/conditions come at extra cost. Then there is stamp duty, developer contributions to local council, state government infrastructure levies, the water authority’s developer charge and GST.

Malone says energy efficiency is greatly improved by adding insulation but some of the other measures may be overkill. Increasingly builders fed up with trying to navigate a NCC edition of ~3,000 pages are turning their backs on the industry.

Energy Efficiency Council chief executive Luke Menzel warned that if improvements to the NCC were paused, Planners might introduce their own rules for things like electric vehicle charging provisions in multi-unit developments.

Employers’ perspectives on hiring and keeping

apprentices

I recently listened to MEGT CEO Matthew Hick talk about the number of new apprenticeship places having gone from a steady 250,000 before 2012, to 150,000 following Commonwealth wage subsidy cuts.

Now scrapping of the employer 10/10/5 per cent 3-year wage subsidy on 1 July 2025, may impact apprenticeship places by another 30% nationally. He says the cuts are to fund the Albanese Government’s ‘free’ TAFE program, however are having unintended consequences for the labour market at a time when employers should be incentivised.

I did a deeper dive into employers’ perspectives on hiring apprentices, particularly related

to the construction sector.

The Recruitment Experiences and Outlook Survey (REOS) captures monthly responses from around 1,000 Australian employers and, since 2021, records those whose most recent hire was an apprentice. The results offer rare insights on apprentice recruitment, including difficulty, recruitment methods, and whether roles were new or replacement positions.

Annually, about 3% of surveyed employers reported recruiting apprentices—roughly matching trade apprentice vacancy shares (about 2%) in the Internet Vacancy Index. The majority of these trials occurred within the Construction, Manufacturing, and Other Services sectors, which account for approximately 80% of apprentice recruitment—a figure broadly aligned with national apprentice commencement data.

Two-thirds (66%) of apprentice roles were for new positions—significantly higher than the 28% observed across all vacancy types.

Recruitment difficulty for apprentices (46%) was lower than the average for all vacancies (55%). However, Manufacturing (55%) and Other Services (51%) reported more challenges, compared to Construction (32%).

Interesting, navigating the legislative requirements for ‘working conditions/hours/wages’ across most industries including construction, was only attributed to difficulty recruiting apprentices by an average of 13% of employers.

At 35%, the Construction industry had the lowest use of online jobs boards for apprentices but the highest use of word of mouth for recruitment (41%).

Despite high demand, construction employers face fewer recruitment difficulties compared to other sectors—likely due to stronger pipelines of interested candidates, established training pathways, and industry visibility.

- High visibility of the trades – Construction apprenticeships (carpentry, plumbing, electrical) are well known, promoted in schools, and strongly associated with stable career pathways.

- Established training pipelines – TAFEs, group training organisations, and large construction firms have long-standing apprenticeship programs that make recruitment smoother compared to sectors with less structured pathways.

- Strong word-of-mouth and networks – Many construction employers recruit through informal networks, family, and community connections.

- Consistent demand – Ongoing housing, infrastructure, and renovation activity means apprenticeships are regularly on offer, reinforcing awareness among jobseekers.

- Industry culture – Unlike some smaller or niche trades, construction careers are widely recognised, so candidates are more likely to seek them out proactively.

The vast majority of construction apprenticeships are in the private sector (small to medium businesses, subcontractors, and group training organisations supplying workers to private building firms).

Public sector roles exist but are limited, usually within state/local government infrastructure projects (e.g. water authorities, transport departments, or public housing maintenance), and they represent only a minor share of overall construction apprentices.

In conclusion, despite the loss of wage subsidies, employer appetite for construction apprentices remains strong, supported by expanding TAFE programs and a pipeline of motivated applicants.

Inquiry into Climate Resilience, Victoria

Reports – Inquiry into Climate Resilience – Parliament of Victoria

The Legislative Council’s Inquiry into Climate Resilience, tabled on 12 August 2025, examines how climate change is impacting Victoria’s built environment and infrastructure—such as buildings, transport systems, and flood defenses—and evaluates how well-prepared the state is to adapt and respond to escalating climate risks.

The inquiry’s Terms of Reference, adopted on 4 October 2023, directed attention to the primary climate risks (like heatwaves, bushfires, intense rainfall, floods, droughts, coastal erosion), the government’s responses, and systemic barriers such as insurance, planning, and funding constraints. The Committee engaged extensively through 285 written submissions, eight regional and metropolitan public hearings, site visits, and more than 130 expert witnesses.

Key Climate Risks

The report identifies major threats including:

- Ongoing warming trends, with Victoria’s temperature already up ~1.2°C since 1910, leading to more frequent heatwaves and extreme events;

- Increased bushfire risk with more high-danger days;

- Longer and more intense drought episodes affecting water security;

- Sea level rise (~24 cm by 2050) causing coastal inundation, erosion, and storm surges;

- Flood intensity rising due to heavy rainfall per degree of warming; and

- Compounding effects of overlapping hazards, which amplify vulnerabilities.

Governance, Planning, and Adaptation Frameworks

The report assesses existing adaptation tools: the Climate Change Act 2017, Victoria’s Climate Change Strategy, Adaptation Action Plans (including built environment-specific ones), and the Planning and Environment Act.

It recognizes progress while spotlighting fragmented governance, inconsistent planning overlays, and delays in embedding climate risk in building and planning systems.

Barriers and Systemic Issues

Local governments face funding shortfalls and lack uniform climate risk data. The current “like-for-like” post-disaster rebuilding approach fails to increase resilience—a gap the report counters with calls for a “build-back-better” or “betterment” model. Insurance challenges, including delays and insufficient coverage, further hinder timely recovery and adaptation, necessitating coordinated reform.

Funding, Community, and Equity

Calls for strengthening adaptation funding are strong, especially for local councils and grassroots programs. The report emphasizes embedding First Nations land management practices, ensuring climate justice, and using up-to-date, localized climate risk assessments to avoid maladaptation.

Next Steps

With 82 recommendations and 93 findings, the report presses for implementation across infrastructure design, planning reform, insurance overhaul, data improvements, and equitable funding. The Victorian Government must respond in writing within six months.

Growing Victoria’s Plantations

Growing Victoria’s Plantations Estate To Its Strength | Premier

The Victorian Government is providing $10m funding to boost local non-native timber supply for construction and manufacturing and create more jobs.

Victorian growers looking to develop new plantations can receive up to $1,000 per hectare under the program to assist with plantation establishment activities. Combined with the Commonwealth program, new plantations of 20 hectares or more in Victoria can receive up to $3,000 per hectare, with a cap of up to $200,000 per project.

The aim of the program is to encourage the planting of 16 million trees over 10 years.

Victorian resale market, RPM June 2025

RPM Victorian Resale Feature – June 2025 by RPM Group – Issuu

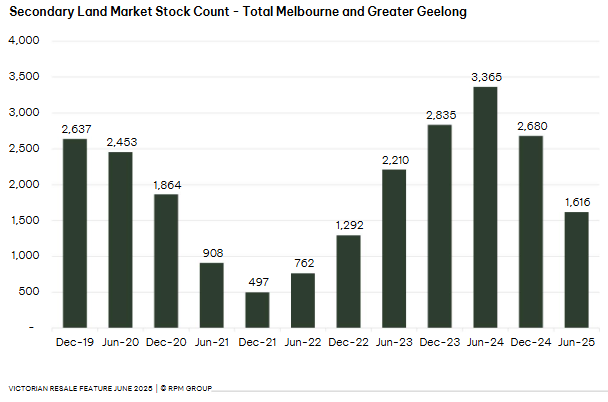

The secondary land market has contracted for a second consecutive sixmonth period and is less than half its peak 12 months ago. In June 2025, resale listings across Melbourne and Geelong totaled 1616, down from

3365 in the June 2024 peak.

Relsale listings make up just 21% of total available stock, down from 39% a year ago. This reduces the risk of resale stock undercutting demand for new projects. The West (661) and North (546) corridors hold the highest amount of stock, compared to Geelong (199) and the South East (210).

The average size (499m2) and price ($446K) of a resale block, is high compared to new release (i.e. 394m2 and $411K), but the sqm rate is marginally lower ($961 vs $1082).

Stockland estates (318) hold more than double the next developer’s resale stock being Frasers (125), followed by Moremac (121) and Villawood (109).

What is a resale lot? A finished lot on-sold by a previous purchaser post-settlement. Resale lots in Melbourne and Geelong ballooned over 2021-2024 with higher interest rates, inflationary building costs and the rising cost of living, meaning building a new home was beyond the means of many.

Why the trend reversal in the last 12-months? In short – lack of developer activity and commencement of a rate cutting cycle. With developers slowing new releases in recent years, these lots fulfill underlying demand. They are generally larger meaning bigger builds, settlement timeframes are short and most of the surrounding neighbourhood is well underway.

Weak toll road growth in Melbourne reflects economic sentiment, Transurban

Transurban Group (TCL ASX) bids for new US toll roads as net profit drops 52pc

Despite average daily traffic across all of Transurban’s toll roads rising by 2.2% in the last year, Melbourne’s growth was the weakest at only 1.2%.

Melbourne traffic is still 2.6% below pre-pandemic levels, with Transurban noting that office occupancy in the Victorian city remained below 60% as many people continue to work from home. This is on top of the Victorian Labour government wanting to give both public and private sector workers the right to work from home at least two days per week.

Victoria’s congestion levy is rising from $1750 to $3030 per parking bay from January 1 . As a tax on public and private operators, the increase is expected to be passed on to those use city car parks next year.

Victorian Greenfield Market Report – Q2 2025

RPM Victorian Greenfield Market Report – Q2 2025 by RPM Group – Issuu

- Confidence has improved through Q2 due to February and May rate cuts.

- Construction costs remain a challenge due to labour shortages.

- Townhomes are at the centre of rising demand from multi-buyer segments.

- The pace of PSP approvals must lift if we are to meet housing targets.

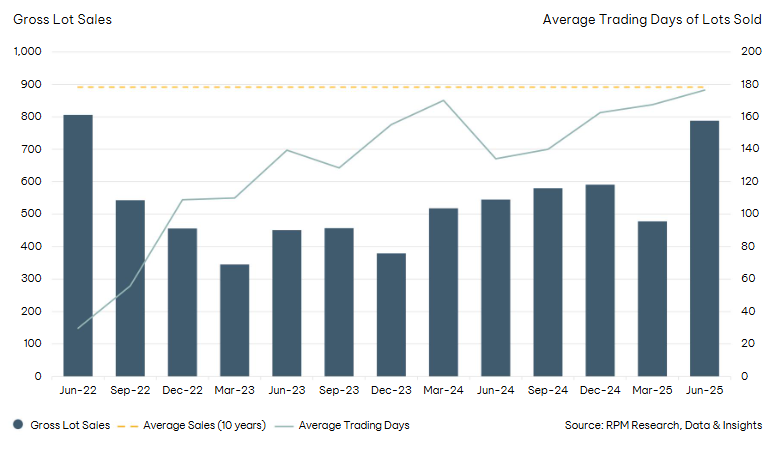

- 3,156 lots were sold across the corridors, which is a jump of 48% on the previous quarter and 36% ahead of the same quarter last year. This is still however 25% below the decade average per quarter of 4,183.

- Median lot size has now returned to its long standing level of 350 sqm.

- Despite developers pushing for higher returns, this translated to a 1.3% drop in the median price to $393,000.

- Total market stock edged up slightly to an estimated 6,178 lots. New releases climbed by 27% to 2,354 lots. This is the biggest lift in quarterly supply since Q3 2022.

- Average trading days to sell a lot has remained between 186-190 for the last two quarters, much higher than traditionally.

- South East corridor recorded the strongest lift in buyer activity in Q2, with gross lots sales rising to 788; a 65% quarterly jump (+45% on a year ago). Casey and Cardinia now account for 28% of Melbourne’s greenfield sales. However trading days rose to 176 – the highest SE quarterly result on record.

- Drouin and Warragul saw lot sales surge 76% to 81 in Q2 (highest since 2021). The sales uplift was matched by new releases up 23% for the quarter and 24% for the year.

South East Corridor Q2 2025

Speeding up approvals for homes on small lots

The Minister for Planning recently announced an update to Clause 54 for assessing a single dwelling and a small second dwelling on a lot of less than 300 sqm in the residential zones.

Effective from 8 September, amendment VC282 makes changes to the Victoria Planning Provisions (VPP) and all planning schemes to extend the new deemed to comply provisions introduced by Amendment VC267 and corrects technical errors in VC267.

Applications complying with 12 prescribed ResCode standards are assessed under the privileges of a VicSmart application and exempt from third party notice and review.

Councils may apply ‘less’ restrictive local variations to street setback, private open space and site coverage. A transitional provision applies for applications lodged before 8 September.